For more than 100 years, the automotive industry has relied on cars with internal combustion engines. Today, transformation is irrevocable. The Covid-19 pandemic makes it a truly Herculean task.

About 13.8 million Europeans, representing 6.1 percent of total EU employment, work in the automotive sector. The industry is responsible for 7 percent of the EUÕs total gross domestic product and is thus a major economic factor.

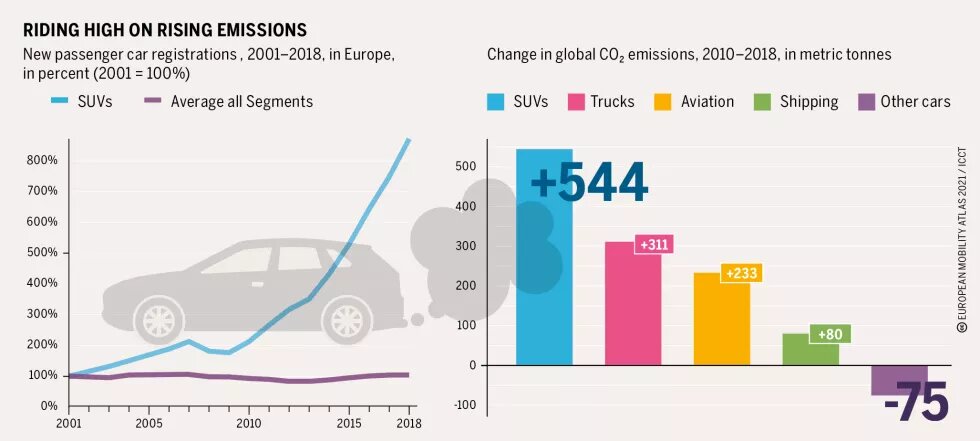

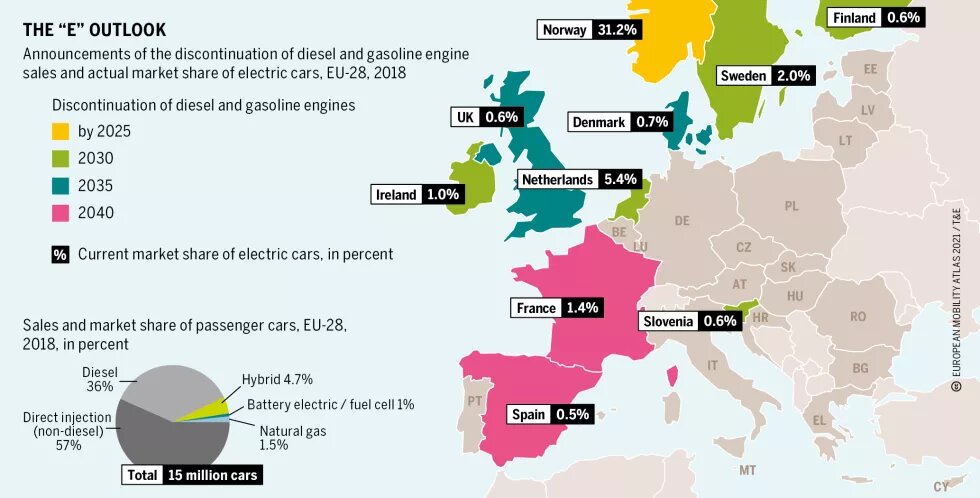

At the same time, the negative consequences of mass motorisation for the environment and health are obvious. Stricter regulations prompted by climate change and air pollution are intended to spur manufacturers to build cars that emit fewer pollutants and greenhouse gases. The transition to zero-emission cars is not only necessary from a climate perspective, it is also an economic imperative. Numerous countries are setting increasingly stringent emissions standards for cars, introducing electric quotas or aiming to ban the sale of internal combustion engines on their markets. Various countries across the EU have already announced plans to phase out new cars with internal combustion engines between 2025 and 2040.

A major change is digitalisation. With the help of artificial intelligence (AI), the car is evolving from a human-driven to a self-driving vehicle. For years, the automobile used to be a status symbol and an independent, private means of transportation. That is currently changing as the car takes its place as one part of a networked and shared mobility system. Competition on world markets is becoming much tougher. If European car manufacturers do not rise to the challenges, they will lose market share. They are not well positioned in the field of electric vehicles. Of the 20 best-selling electric car models worldwide, only four come from European manufacturers. US and Asian manufacturers (e.g. Tesla, BAIC) are leading the field. The European car industry also has some catching up to do in the field of autonomous driving. Google’s autonomous cars are technically so advanced that a safety driver – a human who can intervene during test drives – only needs to act every 17,732 km. In the autonomous cars from Mercedes, an intervention is necessary every 2.41 km. Investments in the fields of the future are imperative for Europe to benefit from the transformation of the automobile and for the industry to remain successful, especially with regard to zero-emission mobility and AI. Manufacturers are increasingly directing their research and development spending toward automated driving and battery-powered electric vehicles that are expected to meet climate policy requirements. It will be more necessary than ever to support workers affected by the transformation with qualification and training measures and to understand that such measures will be an ongoing part of working life in the future.

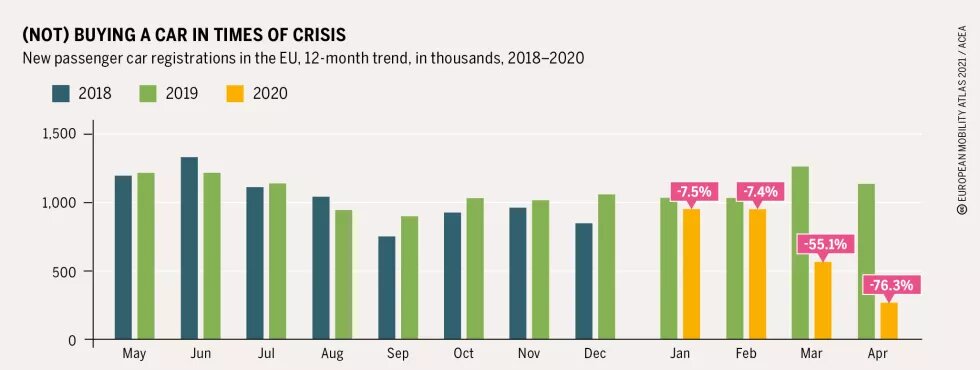

The Covid-19 pandemic, however, has made the much-needed transformation of the automotive sector a truly Herculean task. The European car industry relies heavily on its existing business model of selling fossil-fuel powered cars to finance the transformation and invest in new production lines for electric vehicles. However, the pandemic brought the European car industry to a standstill. Global supply lines were disrupted and car sales plummeted. This massive loss in sales threatens many jobs in the car industry as well as the car manufacturers' ability to transform. It is therefore unsurprising that a range of European Member States have unveiled stimulus packages, aimed at reviving the car industry particularly by boosting sales of electric cars. The German government, for example, intends to invest in more charging stations for electric cars and has doubled incentives to buy electric vehicles. Consumers buying an electric car with a list price of up to 40,000 euros will be eligible for a grant of 6,000 euros.

France, on the other hand, has unveiled an 8 billion euros stimulus package for its automotive industry, which includes a bonus of 3,000 euros for consumers buying a new diesel or petrol car that is cleaner than their previous one. This has an ecological as well as an employment component, given that more workers are engaged in the production of diesel and petrol cars than in electric cars.

However, whether these measures will have the necessary effect of boosting the European automotive industry while simultaneously supporting it on the transformative road towards a sustainable, non-fossil-fuel driven future remains to be seen.

Sources for data and graphics: European Automobile Manufacturers Association, https://bit.ly/3e9j76E; Transport & Environment, The end of the fossil fuel car is on the EU agenda, https://bit.ly/3jIyUdA; International Council on Clean Transportation, European vehicle market statistics 2019, https://bit.ly/2TAKa1e