Facing US pressure to deregulate, Latin American countries are looking for new partners for an ESG (environmental, social and governance) agenda. While China portrays itself as a champion of sustainability, the EU, a former standard-setter losing steam, must decide which side of history it wants to stand on. Whereas institutions in Brussels have historically declared their commitment to defending the rule of law and protecting people and the planet, the main concern in the current context seems to be competitiveness and retaining Europe’s global market share. The EU urgently needs to consider the long-term consequences of its short-term actions.

Since early 2025, there has been increased pressure, primarily from the new US administration, on businesses to abandon ESG policies and practices, and on financial actors to reduce their ESG investments.

Upon taking office in January 2025, US president Donald Trump and his administration have labelled any effort to address human rights or climate-related issues as part of the so-called woke culture, branding it as bad for society and for business. One of the first actions of the new US administration, on day one, was to withdraw from the Paris Agreement, meaning that the country and the companies domiciled under its jurisdiction are no longer formally committed to mitigating climate change and reducing their greenhouse gas emissions to limit global warming. And after that, the anti-ESG sentiment started to grow steadily.

The energy sector as an ESG battle ground

Most of the debate on ESG policies has revolved around the energy sector. President Trump issued an Executive Order in April 2025 titled ‘Protecting American energy from state overreach’, which says that states have enacted or are enacting ‘burdensome and ideologically motivated “climate change” or energy policies that threaten American energy dominance and our economic and national security’. This order is an attempt to undermine the capacity of states to regulate the operations of the energy sector with regards to its environmental impacts under their jurisdictions, imposing the anti-ESG agenda directly from the US federal government. Additionally, the US administration has pursued policies favouring fossil fuel production. They have stated that the real crisis would be ‘energy poverty’ if the world were to transition away from oil and gas.

In May 2025, a study from the Conference Board, drawing on a survey of 125 corporate sustainability and environmental, social and governance executives at leading US and multinational companies, found out that approximately 80% of those companies are adjusting their ESG policies to mitigate legal and political risk, thereby trying to navigate the current political moment of increased scrutiny.

Investors are also behaving in a cautious manner. According to data from Morningstar, support for shareholder resolutions pressing US-based companies for environmental and social reforms fell to 16% on average (for the July 2024–June 2025 period), half the rate of 2022.

Counter-trend in China?

All the while, China has been on a different trajectory, slowly but steadily moving towards more disclosure and green investments. Despite common observations of Chinese practices as being selective and inconsistent, current developments suggest a positive trend. In early 2024, under the guidance of the China Securities Regulatory Commission (CSRC), the country’s three stock exchanges issued ESG reporting guidelines, mandating companies listed domestically and overseas to disclose their ESG data in 2026, while voluntary disclosures have been welcomed since 2025. The guidelines cover a broad range of environmental, social and governance issues, including climate change, pollution, waste management, social contributions and contributions to rural development. Around 450 of the largest companies listed in China are subject to the disclosure requirements.

Towards the end of 2024, the Ministry of Finance published Basic Standards for Corporate Sustainability Disclosure, with general requirements for sustainability information disclosure by enterprises operating in China. This is the first unified standard of its sorts in the country and while initially the disclosure of this information is voluntary, the Ministry has signalled that it intends to introduce mandatory requirements for listed companies, with a gradual expansion to include non-public companies by 2030. In September 2025, the Ministry of Finance also published its Application Guide for the Standards, offering companies detailed instructions for applying this framework.

Additionally, as of 1 October, the Green Finance Endorsed Project Catalogue has taken effect in China, creating a new categorisation system to determine which economic activities are eligible to be funded by green financial products.

Latin America: progress against the odds – but for how long?

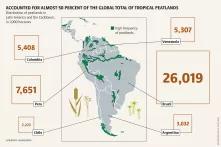

While the two giants – US and China – seem to be moving in different directions, Latin America appears to be caught in the middle. Important progress has been made by governments in the region to increase their disclosure requirements, as well as by companies to incorporate the ESG perspective into their practices, but at the same time, increasing pressure on Latin American markets to deregulate is perceived.

During 2025, the sustainability agenda in the region has continued to be on track in moving from voluntary initiatives to a strategic and regulatory imperative. This trend is driven by growing requirements from governments and investors, and pressure from consumers, making the integration of ESG criteria an important element for operating and accessing capital. Countries like Brazil, Chile, Colombia and Mexico have been moving to adopt mandatory reporting aligned with global standards, including European directives.

The securities authorities in Brazil will have mandatory requirements for its listed companies to disclose ESG impacts as of 2026, including greenhouse gas emissions, water use, waste management, climate risk management, human rights, labour relations and corporate governance. Voluntary disclosure started in 2024.

The Commission for the Financial Market in Chile established a norm for ESG disclosure in 2022, and in 2024 it added elements such as the requirement to use the International Financial Reporting Standards (IFRS) as of 2026, and a new obligation to report on the gender quotas on the boards of directors in 2027.

Colombia has also made progress, with requirements from the stock regulators regarding non-financial reporting entering into force in March 2025.

In 2023, Mexico developed a Sustainable Taxonomy, with the objective of increasing investment in projects and economic activities that promote compliance with the country’s environmental and social objectives and its international commitments in terms of sustainability. In 2025, the focus is to target investments for climate change mitigation and adaptation, and to advance gender equality.

Generally speaking, in Latin America, the climate crisis remains the central pillar of the sustainability agenda, pushing companies toward ambitious carbon-neutral and net-zero goals. The pressure to measure and manage carbon footprints is now extending to small and medium enterprises (SMEs), which creates a set of tensions and challenges, particularly when it comes to applying ESG criteria to SMEs that don’t have enough capacity to apply them adequately.

Human rights are also a key element of the social dimension, particularly reducing inequality in the most unequal region of the world. Despite the challenges, numerous Latin American companies are emerging as global ESG leaders, demonstrating that financial growth and robust sustainability performance are mutually reinforcing.

In that sense, 2025 was meant to be the year in which integrating these criteria would become unavoidable for businesses to align with different and complex international frameworks, positioning early compliance not as an obstacle but as a critical opportunity that would open a pathway for Latin America to achieve market leadership.

But now, with the pressure on international markets coming from the US through tariffs, the anti-regulatory wave and anti-ESG sentiment, this may start to shift. Governments, businesses and investors worldwide are concerned about the commercial disputes between China and the US, and are keeping a close eye on the Trump administration’s medium-term position.

Europe relinquishing leadership on more than just ESG?

In this context, the European Union (EU) was regarded by many as a global power that would uphold its commitments with sustainability, ESG reporting and corporate human rights due diligence. In recent years, the EU has developed a body of directives advancing the requirements for businesses in these areas. The EU Taxonomy for Sustainable Activities from 2020, the Corporate Sustainability Reporting Directive (CSRD) and the Zero Deforestation Regulation, both entering into force in 2023, and the Corporate Sustainability and Due Diligence Directive (CSDDD) from 2024, all changed the regulatory landscape for business operations. These regulations were welcomed by large groups of civil society actors, rights holders, companies and investors. They were expected to provide legal certainty for private actors and an opportunity for prevention and remedy for communities affected by corporate activities.

Latin American providers of European companies were getting ready to comply, and many Latin American governments identified the EU as a potential ally to define global standards and thereby resist President Trump’s regressive measures.

In a concerning move, allegedly to boost European competitiveness and reduce compliance burdens on businesses, the European Commission put forward the Omnibus 1 proposal in February 2025, changing requirements from the CSDDD and CSRD, and dramatically reducing the threshold of companies in scope. A recent decision by the European Parliament reinforced this proposal, scaling back these regulations and delaying reporting until 2028. In the negotiations between the Commission, the Parliament and the Council, the three bodies have reached an agreement that will be rubber-stamped in Parliament in the last days of 2025.

While institutions in Brussels have historically declared their commitment to defending the rule of law and protecting people and the planet, the main concern in the current context seems to be competitiveness and retaining Europe’s global market share. After months of tensions around tariffs between the US and the EU, both administrations came to an agreement in July 2025. Since then, the discussions over the Omnibus proposal seem to have accelerated, reaching the vote in Parliament on 12 November. It appears that the pressure put on the European Union in the current context is delivering results for those interested in deregulation, which is problematic given the global context.

For Latin America, this shift in the EU’s position, from being a leader in ESG regulatory matters to watering down its requirements even before implementation had begun, poses important questions. Will governments continue with their efforts to advance mandatory ESG and sustainability requirements for businesses or will they capitulate to impositions by the US administration?

As the earlier examples show, progressive governments in the region are currently honouring their commitments. But elections are coming up in Chile in 2025, and Colombia and Brazil in 2026, which could change the political landscape and have an impact on those countries’ positions regarding regulation of corporate behaviour, including ESG disclosure.

With the EU withdrawing as a leader in the matter, and the US attacking the ESG agenda, China may emerge as a key actor in this region, as it is already an essential commercial partner for Latin American countries. Even if stakeholders across Latin America have reservations about China’s commitment to sustainability, given the history of environmental and social impacts by Chinese investments, Beijing will have an opportunity to take on the mantle of leadership in this field.

Brussels’ current policy seems to be signalling to its Global South partners that ESG will not be a central agenda for the EU in the coming years. In the case of Latin American, in particular, this could be a missed opportunity. With important leaders posing resistance to what is coming from the US administration and standing by their commitments to incorporate transparency and accountability, the EU could choose to strengthen its partnerships in the region and demonstrate that it will be a longstanding ally to Latin American countries.

The stakes in a new geopolitical world

The stakes are high. Companies have been incorporating ESG issues into their operations and reporting for years now, and many governments around the world have progressed in regulating. Shifting away from these practices and commitments might be perceived by European policy makers as a short-term solution, but it will most likely prove to be a mistake in the long run. As businesses, investors and civil society actors have declared in multiple statements, the ESG journey has already started and it is a path of no return, particularly in the context of the climate crisis. It is what our planet and societies need.

The question then remains: which side of history will the European Union stand on, and will it regain its leadership as a key partner for Latin America. Conversely, at a time when Brussels is under pressure from new great power competition, European politicians must consider what remains of the EU’s global (geo-)political identity if potential partner societies no longer associate it with solidarity and good governance models.

The views and opinions in this article do not necessarily reflect those of the Heinrich-Böll-Stiftung European Union | Global Dialogue.

This text builds on discussions held by the “Expert Delegation on Global Power Shifts” (funded by Heinrich-Böll-Foundation). With a focus on geopolitics, China and the role of the EU, the week-long event took place in Brussels in the early summer of 2025. It brought together academics and practitioners from the foundation’s global network.