Phosphorus is bioessential, meaning that all living organisms require it. Yet, despite its presence in soils, it is a relatively rare element on Earth and is not always found in a form that plants can absorb. The fertiliser industry produces easily soluble phosphorus but depends on a finite, non-substitutable resource: phosphate rock.

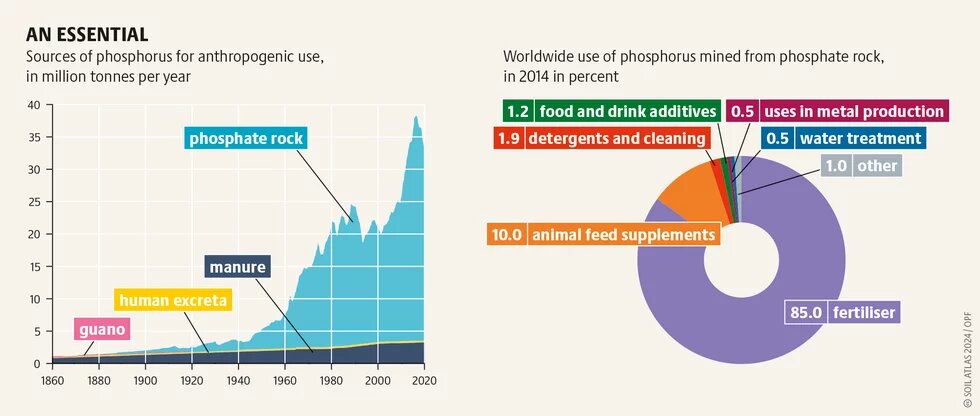

As the use of agrochemical inputs became global after 1950, the mining of phosphate rock increased dramatically. Today, in fact, it is one of the most intensively mined substances on Earth, with production running at over 200 million tonnes per year, ten times more than copper. For close to half a century, phosphate rock and fertilisers were treated as a low-cost, bulk commodity before becoming a strategic resource as a result of hikes in fertiliser prices between 2007 and 2012. At that time, some scientists calculated that the world would soon reach a point of peak phosphorus, when production would start to decline.

Since then, several researchers have rebutted these predictions. While phosphate rock reserves are expected to last at least several hundred years, their geographic distribution is highly concentrated in the Middle East and North Africa. Nearly 70 percent of the world’s phosphate reserves are located in Morocco, which also extracts phosphate rock in the Western Sahara. Another 10 percent is concentrated across Algeria, Egypt, and Tunisia. Other significant reserves are found in China and Russia.

Despite having just one percent of global phosphate reserves, the United States dominated the industry in the 20th century. It was the largest, most technically advanced producer and controlled fertiliser production and trade. Then, following a series of mergers and acquisitions, the North American phosphate industry was reduced to just two major companies, Mosaic and Nutrien, based in the United States and Canada. This high market concentration affords these companies immense power to set prices, leaving farmers, especially those in the Global South, vulnerable to fluctuations. Based in Central Florida next to the large-scale phosphate deposits and with major operations in Peru, Brazil, and Saudi Arabia, Mosaic alone controls 13 percent of the global phosphate market.

However, since the 1990s, the dominance of North American firms has been increasingly challenged by by state-owned or state-controlled companies from emerging economies. China’s phosphate industry is comprised of various companies, including the Yuntianhua Group, which is formally private but subject to significant state influence. China extracts almost half of the world’s phosphate rock and processes it all domestically to produce fertilisers. Although China exports some of its output, the focus is on the domestic market, and this is reinforced by trade barriers imposed during price hikes. In Morocco, the state company OCP Group dominates the phosphate sector and accounts for more than one-third of global phosphate rock exports.

The declining dominance of North American companies is caused by geological factors and more costly environmental regulation. Every tonne of phosphate fertiliser results in the production of five tonnes of phosphogypsum, a toxic and mildly radioactive by-product. In the United States, phosphogypsum has to be stored in enormous stacks, whereas in other countries, such as Morocco, it can be dumped into the sea. Most phosphate rock is extracted in open-pit mines, leading to significant land-use changes and conflicts.

Although phosphate reserves are finite, phosphorus as an element does not deplete on Earth. Most mined phosphorus ends up in water bodies due to nutrient losses in the fertiliser value chain, and soil erosion, as well as through sewage systems. In aquatic ecosystems, phosphorus contributes to excessive growth of algae, which produces dead zones largely devoid of marine life. The planetary boundary for phosphorus has already been transgressed to a point where the environment can no longer self-regulate.

Recycling phosphorus helps overcome the dual problem of finite resources and water pollution. In many European cities, phosphorus is extracted from food waste in large-scale composting facilities, but on average only 30 percent of all organic waste is recollected. Recent recycling efforts have focused on human excreta. For instance, in Germany, the recycling of phosphorus in municipal sewage facilities will be mandatory as of 2029. However, this approach focuses solely on recycling phosphorus from existing sewage systems, which ignores other nutrients like nitrogen. More encompassing methods can be found in the Saint-Vincent-de-Paul urban development project in the heart of Paris. It will use toilets that separate urine from solid waste with water-saving flush systems. The collected urine will be processed into a fertiliser and used to enrich urban green spaces.

Bones are often overlooked as a source of phosphorus. Yet, they contain the highest concentration of phosphorus among organic materials. In the EU, more than 4 million tonnes of animal bones are discarded each year. This translates to 294,000 tonnes of phosphorus – one-third of the EU’s overall demand. In contrast to recycling human excreta, the re-use of animal bones has not yet been broached politically.

The phosphorus issue should be addressed not only through technological innovation, but also through social change. Plant-based diets require less land and thus reduce overall demand for crops and fertilisers. Agroeocological techniques do not depend on mineral fertilisers, and instead, use organic sources to improve soil health and fertility. Moreover, applying green manure both increases biodiversity above ground and microbial life in the soil, which makes phosphorus more readily available to plants.