As in many previous global climate summits, progress on core climate finance issues at COP26 in Glasgow proved to be key to break negotiation deadlocks in overtime and to reach, often inadequate, compromises in a package deal delivered as the Glasgow Climate Pact. Outside of the formal negotiations a dizzying array of new financing initiatives were announced. Skepticism is warranted regarding their staying power, accountability, and impact beyond the Glasgow PR blitz that promised some action but no systemic rethinking.

What was delivered in Glasgow on climate finance with some 20 different agenda items in the negotiated texts was in many ways disappointing, a “glass less than half full” when compared to what was needed and hoped for. Nevertheless, the way that some climate finance discourses were refocused and shifted, especially on finance for adaptation and loss and damage, seen with some careful “glass half full” optimism, could pave the way for better climate finance outcomes in the future, some potentially as early as COP27.

At Glasgow, a multitude of formal and informal climate finance related issues were negotiated and decided across the UNFCCC, the Paris Agreement, and the Kyoto Protocol. They included annual routine matters, such as the guidance of the negotiating bodies to multilateral climate funds under their financial mechanisms like the Green Climate Fund (GCF)and the Global Environment Facility (GEF); seeking accountability for fulfillment of existing commitments, such as the shortcomings to reach existing long-term finance goals, in particular address inadequate financing for adaptation; and the visionary and ambitious, such as starting the process in Glasgow for a new collective climate finance goal post-2025 and to generate and channel finance to address loss and damage. Collectively, they underscore the centrality of scaling up climate finance to increase ambition and accelerate implementation of mandated efforts under the Paris Agreement to keep global warming to 1.5°C. This urgency was underscored in the Glasgow Climate Pact which “Expresses alarm and utmost concern that human activities have caused around 1.1 °C of warming to date, that impacts are already being felt in every region, and that carbon budgets consistent with achieving the Paris Agreement temperature goal are now small and rapidly depleted”.

Accountability for the US$100 billion goal

The mobilization and delivery of climate finance from developed countries to developing countries is a core mandate under the UNFCCC which formally recognizes that developing countries have historically contributed less to climate change than industrialized countries and need support in transforming their economies and achieving ambitious climate goals, including for ratcheting up their own commitments under the Paris Agreement. Fulfilling related commitments is thus the lynchpin for maintaining trust in the multilateral climate process. As such the non-delivery of the US$100 billion climate finance goal by 2020, which was set in the 2009 Copenhagen Accord, formalized in Cancun in 2010 and extended in Paris to apply until 2025, provided a contentious starting point for climate talks in Glasgow. Updated 2019 numbers from the OECD highlighted an existing annual gap of at least US$20 billion. Climate finance numbers from the fourth Biennial Assessment Report (4th BA) on climate finance flows by the UNFCCC Standing Committee on Finance (SCF) presented at COP26 also show a significant gap. According to the 4th BA, Annex II, industrialized countries reported an annual average of US$48.7 billion in public financial support to the Convention 2017-2018, with another US$25 billion annually in climate finance provided by multilateral development banks and attributable to developed countries and around US$2.7 billion approved annually through multilateral climate funds.

A Climate Finance Delivery Plan compiled by Germany and Canada at the request of the UK COP26 Presidency and presented shortly before Glasgow confirmed the gap and indicated based on OECD forward-looking scenarios that it could be closed by 2023, but fell short of guaranteeing earlier shortfalls would be paid up. Additional commitment by developed countries during high level segments of COP 26, such as Japan’s pledge for an additional US$10 billion over 2021-25, led some developed country representatives, including US Special Climate Envoy John Kerry, to declare that the gap could be closed even earlier. The United States was among the countries that increased their annual climate finance commitments in the lead-up to COP26. President Biden’s promised that America’s annual climate finance contribution to the US$100 billion would reach US$11.4 billion by 2024. This still trails other countries’ more generous commitments, such as Norway’s and Sweden’s and including Germany’s promised €6 billion per year by 2025, according to some calculations of a country’s share of international climate finance corresponding to its emissions and economic might. And it is a far cry from what some climate justice groups have calculated as America’s fair share to address the climate crisis, which based on needs of impacted developing countries and the damage caused by US historic emissions under a climate justice framing has been estimated to be up US$800 billion until 2030.

While the Glasgow Climate Pact uses unusually strong language to note “with deep regret” that the goal has not yet been met and “Urges developed country Parties to fully deliver on the US$100 billion goal urgently and through to 2025”, it does not include a commitment to an aggregate sum of US$500 billion to be mobilized 2021-2025, as demanded by developing countries and civil society networks as an outcome for COP26. The concern over a lack of formalized accountability and transparency on reaching the US$100 billion annual delivery during this timeframe is why developing countries also strongly pushed for the continuation of the long-term finance (LTF) work program launched at COP17 in 2011 beyond 2020. In contrast, developed countries argued that ex ante and ex post climate finance submissions required under the Paris Agreement provided sufficient monitoring, reporting, and verification (MRV).

The COP26 decision to continue discussions on LTF until 2027, including through mandates to the SCF to submit a report at COP27 on progress towards achieving the goal given developed countries’ promises under the Climate Finance Delivery Plan and to the Presidency to convene a high level ministerial dialogue on climate finance on such progress in 2022, can be seen as a modest win for developing countries. Given the two year time-delay in verifying data on climate finance mobilized by industrialized countries, the conclusion of the LTF deliberations in 2027 is aimed to ensure full accountability for climate finance delivery under this commitment up to and including in 2025.

Climate finance definition remains elusive

Accountability for climate finance delivery is impossible without a clear understanding of what counts as climate finance. Unfortunately, efforts by developing countries to address this long-standing deficit in the multilateral climate process at COP 26 by anchoring a mandate for the development of a single multilaterally agreed upon definition of climate finance in the continued LTF deliberations and in the process for a new collective climate finance goal—and to reflect this mandate in the broader Glasgow Climate Pact—were stymied by strong opposition from industrialized countries. The latter point to the “bottom-up” nature of commitments under the Paris Agreement and argue that their countries should be allowed to utilize their own understanding of climate finance. The lack of a common definition of climate finance has undermined MRV and assessments of comparability, adequacy and predictability of developed countries’ promised and delivered climate finance. In the past, industrialized countries have been skimpy with details, if not outright deceptive regarding the methodologies or assumptions underlying their reported climate finance figures.

The LTF decision from Glasgow now only contains a request to the SCF “to continue its work on definitions of climate finance” based on submissions received by countries in the course of previous SCF work, such as crafting operational definitions of what is considered adaptation or mitigation finance for use in its biennial assessment report on climate finance flows, and to provide input to the COP on this issue at COP27. This is echoed in the COP decision on matters related to the SCF. While this continues the discourse on ways to improve a common understanding of what climate finance is or not, this is a far cry from providing the irrefutable methodological baseline against which all fulfillments of climate finance commitments and pledges have to be measured.

Instead, definitional and methodological progress is fragmented, incremental and far from uniform. At COP26, the need for industrialized countries to provide more clarity on their pledges toward the fulfillment of the US$100 billion goal was acknowledged in the Glasgow Climate Pact in the context of the assessment of developed countries’ first biennial submission of their ex ante indicated qualitative and quantitative climate finance reporting under Article 9.5 of the Paris Agreement in 2020. The related decision states with concern that not all industrialized countries fulfilled their mandate to submit this information. It urges them to submit their second biennial communication before the end of 2022 while addressing some of the shortcomings and deficits in the reporting of financial pledges that the first synthesis report of the communications received had revealed, including more transparency on methodologies and assumptions used. In particular, developed countries are asked to enhance the quality and granularity of the information they provide to be more clear on projected levels of climate finance, themes (adaptation or mitigation), and financial instruments (grants or loans), as well as channels (bilateral actors or multilateral funds) to be used and specifically what share of finance might be intended to support least developed countries (LDCs) and small island developing states (SIDS).

Urgently scaling up adaptation finance

Going into COP26, it was clear that any Glasgow outcome worth mentioning would have to significantly increase collective and qualitatively improved commitments to adaptation finance. This was especially important in light of the still elusive balanced climate finance allocation between mitigation and adaptation promised in the Paris Agreement (with just between 20 and 25 percent of climate finance provided to developing countries for adaptation, according to the OECD and the SCF reports) and a significant increase of adaptation finance delivered as loans (with the MDBs as the main culprits) . At the same time, and as highlighted by the new IPCC 6th Assessment Report on the physical science basis, urgent scaling up of financial support cannot be further delayed to increase adaptive capacity, reduce vulnerability and strengthen resilience of developing countries in light of the adverse impacts of accelerating temperature that already affects them disproportionally.

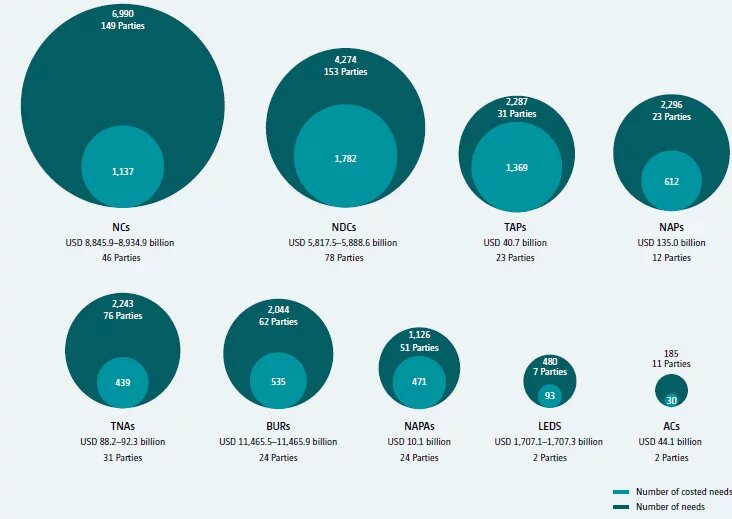

For the first time, the cover decision of the Glasgow Climate Pact includes a separate section on adaptation finance. It uses strong language and “Notes with concern” the current insufficient provision of adaptation finance to address “worsening climate change impacts in developing country Parties” and “Urges developed country Parties to urgently and significantly scale up” adaptation finance. After contentious negotiations, and with the United States a strong holdout, the CMA decision prominently included a call urging “developed country Parties to at least double their collective provision of climate finance for adaptation to developing country Parties from 2019 levels by 2025”. With 2019 as the base year with the latest OECD figures available (see Figure 1), a doubling by 2025 would mobilize US$ 40 billion for adaptation.

Figure 1: OECD 2019: thematic split of climate finance mobilized and provided in US$ billion

While a doubling would mean a significant improvement, it still falls short of the long promised parity and the quadrupling of current commitments that developing countries had pushed for during the negotiations. Although the new commitment is a victory of sorts, it fails the test of adequacy and remains significantly below the basic needs for adaptation that for example the UN Environment Programme (UNEP) estimates to be in the range of US$ 70 billion annually for developing countries, a figure that could reach US$ 300 billion by 2030 if mitigation ambitions are not realized. Many developing countries are already spending a significant portion of their GDP for adaptation measures domestically; a study of adaptation expenditures in a number of African countries found domestic efforts for adaptation already surpassing social expenditures for health or education. With adaptation finance currently provided too often in the form of loans, the fiscal space in those countries – many already heavily indebted and facing unsustainable debt burdens – to support social safety measures so important to increase communities’ resilience to climate shocks is further reduced. This has disproportionate impacts on women, who often have to act as the care and service provider of last resort when public social systems are inadequate, underfinanced or fail in the wake of severe climate impacts. Unfortunately, there is no mention in the Glasgow Climate Pact on the need to focus adaptation finance, or for this matter, finance more broadly, in support of locally-led and gender-responsive climate actions. Indeed, the only applicable reference comes in a weak process-focused decision on gender and climate change, where countries are encouraged “to be more explicit about the gender-responsiveness of climate finance with a view to … facilitate access to climate finance for grass-roots women’s organizations as well as for indigenous peoples and local communities”.

It is thus disappointing that the section on adaptation finance in the Glasgow Climate Pact is silent on the need to scale up adaptation finance by prioritizing grant provision, as is the decision on long-term finance. The cover decision’s call for increasing the “adequacy and predictability of adaptation finance” including by weakly “inviting” industrialized countries “to consider multi-annual pledges” is not strong enough to make up for this omission.

However, in what can only be seen as a clear reaction to the increased civil society and developing country pressure for a clear upward trajectory for adaptation finance, COP26 saw a number of new developed country pledges (although most of them ‘one-off’, not multi-year), totaling US$356 million for the Adaptation Fund and US$413 million for the Least Developed Countries Fund (LDCF). Both funds are tasked with helping developing countries implement urgent climate actions by providing grants and have been chronically underfunded. Promised contributions for the Adaptation Fund, established 2007 under the Kyoto Protocol but since 2019 also serving the Paris Agreement, for the first time included pledges for US$50 million by the United States and for US$8.1 million by Canada; both countries are not parties to the Kyoto Protocol and had not provided funding previously.

This new North American support will come at a cost: the United States especially pushed for clear language in decisions on the Adaptation Fund’s scheduled fourth review at COP27 and taking stock of its activities that reiterate “that developing country Parties and developed country Parties that are Parties to the Paris Agreement are eligible for membership on the Adaptation Fund Board.” During the negotiations, the United States had at various points seemingly pushed for a reconsideration of the Adaptatiion Fund Board governance structure as part of the mandated review. This raised red flags by developing countries concerned that their equitable representation on the Adaptation Fund Board, in which they hold a clear majority with 10 of the 16 Board seats—the only multilateral climate fund where this is the case—might be under attack. While this specter seems averted for now, it is likely that a ‘North American’ chair (with the United States holding the Board member seat and Canada as an alternate) could be added. In fact, the COP26 decision on Adaptation Fund matters in confirming the eligibility of Parties to the Paris Agreement for membership to the Adaptation Fund Board asked to formally start the process “to amend the relevant procedures and modalities”.

Under the Kyoto Protocol, the Adaptation Fund received a 2 percent share of proceeds of certified emission reductions (CERs) under the Clean Development Mechanism (CDM), the only mandated automated finance provision in support of any multilateral climate fund. The Paris Agreement under Article 6, paragraph 4 established a new market mechanism, the Sustainable Development Mechanism (SDM), for emissions-trading on a voluntary basis, which likewise mandates that a “share of the proceeds from activities” be used “to assist developing country Parties that are particularly vulnerable to the adverse effects of climate change to meet the costs of adaptation.” Going into Glasgow, agreement on Article 6 rules and procedures remained the only part of the Paris Rulebook still undecided. After four years of negotiations, a deal on Article 6, including on the “share of proceeds” going to support adaptation was finally reached at COP26. Under the SDM (Article 6.4), the proceeds of a mandatory 5 percent of traded offsets to be canceled will finance urgent adaptation actions under the Adaptation Fund. In Glasgow, as previously in 2019 in Madrid, developing countries had pushed to have a similar mandate for setting aside an equal “share of proceeds” from selling carbon offsets for adaptation finance under Article 6.2 of the Paris Agreement for “internationally transferred mitigation outcomes” (ITMOs), but faced stiff opposition by the United States and to a lesser extent the European Union (EU) that could not be overcome. Under the adopted Glasgow decision on Article 6.2, countries and participants in cooperative approaches trading bilaterally are now only “strongly encouraged to commit to contribute resources for adaptation, in particular through contributions to the Adaptation Fund” through the cancelation of offsets on a voluntary basis; the Adaptation Fund is asked in its annual report to the CMA to detail how much it will have received from such voluntarily shared proceeds.

New collective quantified goal on climate finance

Closely related to the long-term finance discourse in Glasgow under the COP, which focused on creating accountability for the quantitative and qualitative fulfillment of the US$100 billion annual target through 2025, were the technical discussions under the CMA for a new collective quantified goal on climate finance post-2025 supposed to replace it. Unlike the US$100 billion target, which was set as political aspiration in a backroom deal dominated by developed countries in 2009, developing countries this time around were pushing for a formal negotiation process resulting in a financial goal grounded in scientific analysis of their financial needs and applying lessons learned from the shortcomings of the Copenhagen target. These would include enshrining the primacy of public finance, especially through significant grant provision, and setting short-term intermediate time targets and financial goal posts for an ambitious scaling up towards a much higher new goal starting from the US$100 billion baseline.

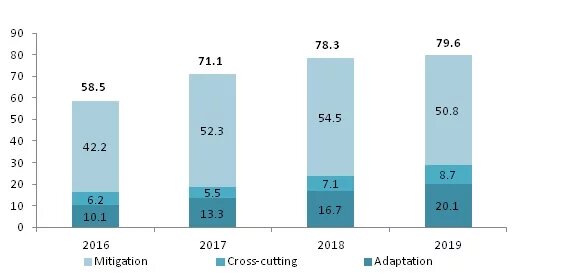

Developing countries were aided in their call for significantly increased scale by the first ever assessment report by the SCF on developing countries’ needs for implementing the Paris agreement, which was presented in Glasgow. It collated developing countries’ needs identified through a number of formal mandated submissions, including national communications (NCs), nationally determined contributions (NDCs), or national adaptation plans (NAPs). Where cost-estimates were provided (see Figure 2), those were aggregated, determining financial needs of US$135 billion identified for 612 detailed actions in just 12 NAPs, and financial needs of US$8.9 trillion until 2030 identified in NCs submitted by only 46 countries for 1,137 costed actions. The COP decision on the SCF, formally notes the scale of developing countries’ financial needs as transparently derived through UNFCCC processes, and singles out the 1,782 financial needs identified by developing countries across just 78 NDCs of up to US$5.9 trillion until 2030 alone. This does not yet include the US$1 trillion India, which did not submit an updated NDC in time for Glasgow, says it needs to transition to carbon neutrality by 2070, including by building 500 gigawatts of renewable energy by 2030, as announced during COP26. The SCF decision does explicitly note that developing countries’ needs are significantly undercounted, because “there is a lack of available data, tools and capacity for assessing adaptation needs” as well as the particular challenge in “deriving cost estimates for averting, minimizing and addressing loss and damage needs”.

Figure 2: Overview of needs, including costed needs, articulated by Parties in submission to the UNFCCC

Going into the negotiations, the Like-Minded Developing Countries (LMDCs) and the African Group had put forward a submission outlining that “a quantum mobilization target should start from range of a commitment by developed countries to mobilize jointly at least US$ 1.3 trillion per year by 2030, of which 50% for mitigation and 50% for adaptation and a significant percentage on grant basis from a floor of US$ 100 billion, taking into account the needs and priorities of developing countries outlined in the updated NDCs”. Developing countries also pushed for the inclusion of finance for loss and damage into setting a new collective quantified climate finance goal. Both calls saw furious push-back by developed countries, who in contrast sought to include language on the need to broaden the base of countries contributing finance to the new collective goal beyond developed countries and on leveraging private finance flows particularly. An inclusion of the ambitious finance goal set by the LMDC and the African group in an earlier version of a decision on the new collective quantified goal was quickly removed in subsequent drafts.

The final decision, which decides that the new collective quantified goal will be set in 2024, is now largely procedural. The main reference on substance of focus and scale is the rather generic promise that the process will “take into account the needs and priorities of developing countries and include, inter alia, quantity, quality, scope and access features, as well as sources of funding, of the goal and transparency arrangements to track progress towards achievement of the goal”. This language could theoretically allow for the inclusion of loss and damage finance as a third finance pillar under the collective goal under a future discussion of its scope. The decision establishes a three year ad hoc work programme from 2022 to 2024 to be facilitated by two appointed co-chairs, with four technical expert dialogues per year (including two regional ones) to be organized by taking into consideration stakeholder submissions, scientific information and especially IPCC findings, and the SCF needs and financial flow reports. Annual ministerial high level dialogues and annual progress, technical and summary reports delivered to the CMAs over the next three years are outlined as part of “cyclical” deliberations in which political discourses are to guide technical work, which is to inform the political discussions.

The decision emphasizes that the deliberations are to be conducted “in an open, inclusive and transparent manner ensuring participatory representativeness”—one of the few issues on process on which all countries agreed. This consensus is in contrast to the diverse positions on the format of the process, where several modalities of differing formality and structure were proposed by different groups of developing countries and developed countries. For example developing countries disagreed on whether an ad hoc committee or an ad hoc work programme was the better approach.

Ultimately, the formalization of the process to determine the new post-2025 finance goal as an ad hoc work programme is a win for developing countries and the broader public, as developed countries had attempted to lowball the deliberations to much less structure—and less binding—in-session workshops and seminars only. For the credibility of the new collective goal to be set in 2024, full transparency and accountability of the process and the participation of diverse stakeholders—including from experts of civil society, academia and the private sector—in the deliberations is crucial. All meetings under the ad hoc work programme are supposed to be open to observers and webcast.

Securing finance for loss and damage

Article 8 of the 2015 Paris Agreement formally established loss and damage—the unavoidable impacts of climate change beyond the capacity of countries, communities and people to adapt and build resilience to—as the third pillar of international climate action in addition to mitigation and adaptation. By some estimates, the economic cost of loss and damage in developing countries alone could be in the magnitude of US$290 billion to 580 billion a year by 2030, not counting non-economic loss and damage (such as loss of culture or heritage). However, language on climate finance provision and related finance agreements in the climate process have so far omitted references to financial support for loss and damage for developing countries. This reflects developed countries’ efforts to avoid discussions on finance for loss and damage in the context of their historic responsibility for climate change as made explicit in Paragraph 51 of the COP21 Decision on the Paris Agreement which states that "Article 8 of the Agreement does not involve or provide a basis for any liability or compensation". Instead, the Paris Agreement focused on the Warsaw International Mechanism (WIM), established in 2013, and reaffirmed its three priority task of enhancing understanding of approaches to address loss and damage; strengthening dialogue coherence, coordination, and synergies between relevant stakeholders; and enhancing action and support to address loss and damage in vulnerable developing countries. However, to the frustration of developing countries, the WIM since Paris has so far failed to provide focus and substance on enhancing action, including financial support, for loss and damage.

At COP26, financing for loss and damage, never formally on the agenda, emerged as one of the key issues dominating the narrative of the summit and ultimately holding up the negotiations. In effect, for developing countries, as well as for international civil society, progress on loss and damage finance in Glasgow became the litmus test for success or failure of COP26. By this framing, COP26 failed. Instead of kick-starting a new finance facility for loss and damage, COP26 only offered a multi-year Glasgow Dialogue as a forum running until June 2024 to discuss the arrangements for the funding of activities to address, mitigate, and avert loss and damage. The little money promised for loss and damage in Glasgow came in the form of small-scale funding in support of efforts to fully operationalize the Santiago Network on Loss and Damage (SNLD), set up at COP25 in Madrid under the WIM. Germany pledged € 10 million for this purpose, and Canada also promised support for the SNLD, which, among several functions, will eventually pay for demand-driven technical assistance to developing countries to help them assess and deal with loss and damage, but will not be structured to allow for channeling larger sums for loss and damage interventions. Outside of the UNFCCC, smaller amounts were also pledged by Scotland (£2 million), Wallonia (€1 million) and several philanthropies (US$ 3 million) in support of vulnerable countries and communities already suffering loss and damage. These were meant as political ‘seed funding’ to invite multiplication and replication. Scotland’s contribution is precedent-setting, as it is the first developed country formally giving money for the purpose of addressing loss and damage.

In Glasgow, unfortunately, the Scottish example was not enough to overcome developed countries’ resistance, lead by the US and EU, against the establishment of a separate Glasgow Facility on Loss and Damage Finance, which developing countries (the 134 countries of the G77+ China coalition) collectively called for in draft decision language they submitted based on an earlier proposal by small island nations (AOSIS). This language, if accepted, would have started a process of fleshing out details for a facility to then be fully finalized at COP27. Instead, developing countries had to accept the weak minimal consensus provided by the decision under the Glasgow Climate Pact “to establish the Glasgow Dialogue between Parties, relevant organizations and stakeholders to discuss the arrangements for the funding of activities to avert, minimize and address loss and damage” as a yearly talk-shop starting at the next Subsidiary Body on Implementation (SBI) meeting in 2022 and running until June 2024. In accepting that compromise, developing countries made it clear that there could be no other outcome from the Glasgow Dialogue on loss and damage finance than the establishment of a new separate finance facility and that their patience is exhausted. Indeed, small island nations Tuvalu and Antigua and Barbuba, just at the start of COP26, registered a new Commission of Small Island Developing States on Climate Change and International Law with the United Nations that would give them the possibility of exploring options for claiming compensation for climate damages from major polluting countries through judicial means, such as the UN's International Tribunal for the Law of the Sea, if the establishment of a formal loss and damage finance mechanism fails.

While COP26 thus overall fell short on loss and damage—for example, efforts to establish the topic as a permanent agenda item of the subsidiary bodies failed—its visibility as an issue that can no longer be pushed aside, despite developed countries’ best efforts, was unprecedented. It seemed fitting that the thematic adaptation and loss and damage day at COP26 at the beginning of the second week of talks took place on the 8th anniversary of Super Typhoon Haiyan, which devastated the Philippines in 2013 and is seen as a core example of the economic, human and cultural loss and damage suffered on the front lines of the climate emergency. For the first time ever, language on loss and damage finance was also solidly anchored in the cover decision of the Glasgow Climate Pact, which “Reiterates the urgency of scaling up action and support, as appropriate, including finance” and “Urges developed country Parties, the operating entities of the Financial Mechanism, United Nations entities and intergovernmental organizations and other bilateral and multilateral institutions, including non-governmental organizations and provide sources, to provide enhanced and additional support for activities addressing loss and damage” in addition to setting up the Glasgow Dialogue.

In the aftermath of Glasgow, in many developed countries’ capitals a reckoning with the unavoidability of supporting developing countries for loss and damage and figuring out the best way to do so while skirting liability has begun. This sets the scene for a breakthrough on loss and damage finance in 2022 at COP27, especially if the collective pressure by civil society and developing countries is maintained. One crucial way to anchor loss and damage finance lastingly, and with a significant amount, in the climate process will be through the negotiations on a “new collective quantified goal on climate finance”, which will begin in earnest in 2022, where the largely procedural agreed outcome leaves room to include loss and damage finance explicitly in the new goal’s financing scope.

Shifting the trillions

Article 2.1.c of the Paris Agreement acknowledged the need for “Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” The Glasgow Climate Pact reiterates this call by calling out “developed country Parties, multilateral development banks and other financial institutions to accelerate the alignment of their financing activities with the goals of the Paris Agreement”. A chapter on mapping efforts and progress, as well as scrutinizing methodological challenges and inconsistencies in shifting the trillions in finance flows into climate-compatibility was included for the first time in the SCF’s 2020 4th Biennial Assessment report presented in Glasgow. It analyzed data (see Figure 3) related to some 115 sustainability or climate-related financial initiatives, sporting 5,181 constituent members, that claim to be either directly or indirectly associated with contributing to the goals of the Paris Agreement, either by offering new financial instruments for green investments, or, in some 31 cases, by focusing on greening financial systems, through initiatives such the Task Force on Climate-Related Financial Disclosures (TCFD), theEuropean Union High Level Expert Group on Sustainable Finance, and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) to name but a few.

Figure 3: Scale of greater finance flows to be shifted according to the SCF 4th Biennial Assessment

With such a multitude and great variety of efforts, the 4th BA report critically noted that “a plethora of initiatives offers the potential for incoherence and different levels of ambition in articulating how the goal in Article 2, paragraph 1(c) may be met” and worried that “the absence of any independent critique of the motives and impacts of the numerous finance-related initiatives” makes “assessing the real world contributions of these many initiatives towards achieving consistency of finance flows and combating greenwashing” difficult.

These challenges and concerns—as well as sound skepticism—also apply to many, if not most of the finance-related announcements made on the sidelines of COP26 in Glasgow, including those prominently announced during the COP’s ‘Finance day’.

Net-zero private sector finance promises

The media fanfare around the Glasgow Financial Alliance for Net-Zero (GFANZ) of leading private sector financial institutions and asset holders with its claim of committing US$130 trillion towards the net-zero transition of the financial sector and economic systems surely deserves scrutiny. GFANZ is actually bundling and PR ‘super-charging’ a number of previously announced commitments and initiatives, as membership in GFANZ—some 450 financial sector actors in 45 countries—is through one of the member alliances, such as the Net Zero Asset Managers initiative (NZAM), the Net-Zero Asset Owner Alliance (NZAOA), the Net-Zero Banking Alliance (NZBA), the Net-Zero Insurance Alliance (NZIA), the Net Zero Investment Consultants Initiative (NZICI), the Net Zero Financial Service Providers Alliance (NZFSPA), and the Paris Aligned Investment Initiative (PAII). GFANZ members are signed up under the United Nations ‘Race to Zero’ and pledge to align with its criteria to work in support of reaching net-zero carbon emissions by 2050, set 2030 interim ‘fair share’ targets towards the 50 percent emissions reductions required by the end of the decade, set and publish a net-zero transition strategy to be reviewed after five years, and commit to annual transparent reporting and accounting on progress against those targets. The initiative is jointly chaired by Mark Carney, UN Special Envoy for Climate Action, and Mike Bloomberg, UN Special Envoy for Climate Ambition and Solutions. Both have also co-founded the TCFD, with GFANZ making TCFD disclosures a central tool of the commitments.

However, critical observers of the announcement were quick to point out that those commitments are pretty meaningless, as they are largely voluntary, and the US$130 trillion represented the already committed asset base of GFANZ members, not an allocation of new financing flowing into green investments. The pledge, for example, did not include a promise to exit all fossil fuel financing. In fact, many of the members of GFANZ continue to invest in coal, oil and gas despite Paris-alignment commitments. Since 2015, the world’s 60 largest commercial banks financed US$3.8 trillion in fossil fuel development. Private equity seeking to maximize profits is actually snatching up some of the dirtiest investment in fossil fuels, with US$ 1.1 trillion financed since 2010. Thus the announcement is more green hype, than green hope, especially since there are no agreed-upon and universally applied metrics to ensure GFANZ portfolio alignment with the Paris Agreement (thus ensuring comparability and aggregation within the alliance). The GFANZ progress report itself acknowledges: “Currently, there is no consensus on which tools and metrics to use or how and when to apply them.” Or to be more precise: GFANZ investors and banks cannot even agree what net-zero is, but they all claim that they will reach it. To make matters worse, this complements the related definitional confusion about what climate finance is. The Science Based Targets Initiative (SBTi) in a recent paper now proposes to develop a science-based net-zero standard for financial institutions to prevent financial greenwashing. This seeks to address concerns voiced by UN Secretary General Guterres that a more stringent set of definitions around net-zero is needed to strengthen the credibility of such claims and the accountability for their fulfillment by non-state actors, if they are to be more than PR announcements; he has set up a commission to address these critical issues.

Decarbonizing public international finance support

The Glasgow Climate Pact made history as the first COP cover decision ever to explicitly target fossil fuels as the driver of global warming. Stronger language was unfortunately watered down in the final version by inserting restrictive qualifiers—establishing carve-outs for false solutions like carbon capture and storage (CCS)—so that the Glasgow outcome only calls for “accelerating efforts towards the phasedown of unabated coal power and phase-out of inefficient fossil fuel subsidies”. According to an analysis by the International Monetary Fund (IMF), globally, fossil fuel subsidies were US$5.9 trillion in 2020, or US$11 million per minute, if externalities like environmental and climate damage or health impacts are taken into account, and could rise further by 2025.

In its road map for the energy sector, the International Energy Agency (IEA) stressed that 2021 should mark the end of funding for new oil, gas and coal projects to keep global warming to 1.5°C. In this context, the commitment at COP26 of 39 countries and institutions, including the United States, Canada, Germany, Spain, UK, France, El Salvador, Costa Rica, Sweden, or Sri Lanka; and public development banks like the European Investment Bank (EIB), the Dutch FMO, Agence Française de Développement (AFD), or the East African Development Bank (EADB), to “end new direct public support for the international unabated fossil fuel energy sector by the end of 2022, except in limited and clearly defined circumstances that are consistent with a 1.5°C warming limit and the goals of the Paris Agreement” and to prioritize clean energy finance is significant. According to calculations by the Big Shift Global Coalition, from 2018 to 2020, the countries signing on to the commitment supported more than US$ 24 billion a year in fossil fuels spending. The participation of those energy financing heavyweights (Canada alone spent US$11 billion per year on fossil fuels) in theview of analysts will increase pressure on some of the biggest hold-out countries, particularly Japan, South Korea, and China, to also commit to ending public fossil fuel finance. A recent briefing showed that G20 governments and public finance institutions provided at least US$188 billion in public finance for fossil fuels between 2018 and 2020. The commitment by the signatory countries, however, does not apply to already approved fossil fuel financing, nor does it preclude continued financing for domestic fossil fuel projects; the wording also allows for loopholes through the inclusion of the reference to ‘unabated’ fossil fuel investments, thus allowing for oil and gas projects ‘abated’ by technologies like CCS.

Multilateral development banks (MDBs) were noticeably absent from the Glasgow public finance commitment to end financing for coal, oil and gas. While MDBs made a joint commitment to align their investments with the Paris Agreement in 20217, initial progress seems to have stalled. The MDB’s collective COP26 statement and a progress report were widely criticized as inadequate for a lack of new details and not committing to curtail financial support for oil and gas projects; only coal- or peat-fired power plants are considered “universally not aligned” with the Paris Agreement. Instead, MDBs touted their role in jointly providing US$ 66 billion in 2020 in climate finance, conveniently omitting their continued role in funding fossil fuel projects, which the Big Global Shift Coalition estimates to be at least US$6.4 billion in 2020 in direct financing, not including further investments through financial intermediaries and policy-based support difficult to track. Campaigners hope that the high level of participation from MDB donor and client shareholder governments in the Glasgow commitment (with an estimated 67 percent of the voting power at the EBRD, 51 percent at the IDB, or 45 percent at the World Bank) could force MDBs to end fossil fuel finance support sooner rather than later, if shareholder governments’ Executive Directors vote in line with their Glasgow commitment.

Criticisms of a failure of the World Bank Group (WBG) under Executive Director David Malpass to step up as a climate leader, including by spearheading the MDBs’ Paris Alignment efforts, were especially pointed in the lead-up to and in Glasgow. The World Bank’s 2021-2025 Climate Change Action Plan (CCAP) released in May 2021 disappointed observers with a lack of new restrictions on financing fossil fuel projects, promising just without providing further detail that “all WBG investments in new gas infrastructure will be assessed for consistency” with national climate and development plans. Meanwhile, promised clarification on the WBG’s time-table for full alignment with the Paris Agreement—including its International Finance Corporation (IFC), which continues to fund fossil fuels, and even coal, through its private equity investment support—remained elusive at COP26. This comes as the International Development Association (IDA), the highly concessional financing arm of the WBG for the 74 poorest and increasingly indebted countries, is completing its replenishment negotiations for the financial support it can provide mid-2022 to mid-2025.

At Glasgow, the other Bretton Woods institution, the IMF, which under Managing Director Kristalina Georgieva has stepped up its policy and analytical engagement advocating for green COVID-19 economic recovery, announced that up to US$50 billion of its July 2021 allocation of US$650 billion in new special drawing rights (SDR) would be used for a Resilience and Sustainability Trust (RST). The RST which could allow especially climate vulnerable countries access to the SDRs as international reserve asset , which disproportionately benefits developed countries as they are the largest IMF shareholders, to support post-COVID low-carbon and climate resilient development and would likely apply conditionalities focused on linking policy reforms and structural reforms to climate change outcomes. It will depend on the structure, eligibility, and access criteria of the RST, which has yet to be set up, whether it can provide an additional climate finance option for some of the most heavily indebted climate vulnerable countries, including many SIDS and LDCs, especially in the aftermath of climate emergencies to deal with resulting domestic liquidity crises.

Supporting emerging economies’ just transition

COP26 saw the first of its kind deal, in which several developed countries agreed to collectively provide a targeted finance package to an emerging economy to speed up its exit from coal and to accelerate a transition to a clean energy economy. An integral part of the deal is a focus on a just transition by targeting economic regeneration in coal mining regions through the creation of alternative green jobs. The United States, UK, France, Germany and the EU after months-long negotiations with South Africa, which largely designed the approach, announced a US$8.5 billion package of grants and concessional finance over the next five years, the Just Energy Transition Partnership. This will help the implementation of South Africa’s revised NDC by accelerating investment in renewable energy and the development of new sectors such as electric vehicles and green hydrogen. The resources are to support South Africa’s debt-burdened state utility Eskom in its goal to shut most of its coal-fired power plants by 2050. Currently, 87 percent of South Africa’s electric power generation comes from using domestically available coal.

The deal, seen as an important finance outcome at COP26, could serve as a template for similar agreements with other states, such as Chile, Vietnam, or Indonesia, which as part of the growing Powering Past Coal Alliance (PPCA) committed in Glasgow to phase out or not build or invest in new coal power. It includes US$500 million for South Africa from a US$2 billion Accelerating Coal Transition (ACT) initiative for emerging economies piloted under the Climate Investment Funds (CIFs), which is supported with funding from the US, the UK, Germany, Canada, and Denmark. In Glasgow, the CIFs announced that India, the Philippines, and Indonesia would be additional beneficiaries of this initiative.

In Glasgow, the Asian Development Bank (ADB) also announced a new partnership with Indonesia and the Philippines to support the early retirement of existing coal plants through the establishment of an Energy Transition Mechanism (ETM), which has yet to secure sufficient financial support beyond US$ 25 million in initial Japanese seed funding. During its three-year pilot phase, the ADB hopes to raise enough financial resources to accelerate the retirement of five to seven coal plants in Indonesia and the Philippines and investments in alternative clean energy options within these countries. A focus on assisting affected workers and communities with alternative skills and livelihood development for a just transition is supposed to be supported through an advisory group that is to include civil society. Ambitious plans for the ETM at full scale could include Vietnam with the aim to retire up to 30 gigawatts of coal power over the next 10 to 15 years.

Forest protection finance initiatives

At COP26, a volley of funding initiatives were announced to address deforestation and harmful land use shifts centered around the Glasgow Leaders’ Declaration on Forests and Land Use, although it remains to be seen how many of these pledges are fully converted into paid commitments with transparent accountability for who will benefit from disbursed funding.

Now 141 countries, whose territory covers 90 percent of the world’s forests, have signed on to the Glasgow Leaders’ Declaration promising to work “collectively to halt and reverse forest loss and land degradation by 2030 while delivering sustainable development and promoting an inclusive rural transformation”. However, the wording of the declaration prompted Indonesia as one of the signatories to declare that it interpreted the commitment as “sustainable forest management … not end deforestation.” This could signal that many of the countries signing on will put their own differing interpretation on the declaration, likely undermining any effort for a meaningful outcome that would focus on the protection and expansion of natural forests through regeneration, not plantation-focused reforestation.

The Glasgow promise echoes earlier, similar initiatives and efforts, from the UN Forum on Forests in 2005 to the New York Declaration on Forests (NYDF) of 2014, in which 200 countries, civil society groups, and Indigenous Peoples organizations likewise committed to end deforestation by 2030, and which has an established action platform. It is not clear whether the Glasgow Leaders’ Declaration would for example build on or use the existing NYDF platform. Similarly, it is unclear to what extent the finance package announced in connection with the Glasgow Leader’s Declaration would create new funding mechanisms or provide funding support through existing ones.

Among the finance announcements made at COP26 in support of the Leaders’ Declaration are US$7.2 billion in unspecified private sector support as well as the US$12 billion Global Forest Finance Pledge to be delivered between 2021 to 2025 via results-based finance, capacity-building, and technical support by 12 developed countries and the EU with the promise to “promote the full, effective, and willing participation of Indigenous Peoples and local communities in programmes that protect and restore forests, reduce deforestation and forest degradation, and ensure that benefits reach smallholders and local communities.” During the same time-frame, the Bezos Earth Fund and many of the same contributors commit to provide at least US$ 1.5 billion to protect the world’s second-largest tropical rainforests in the African Congo Basin, potentially by learning from the Congo Basin Forest Fund, which existed from 2008 to 2014 and delivered mixed results.

Some US$1.7 billion were also pledged by a mix of 23 public and majority philanthropic contributors, including the Ford Foundation, Rainforest Trust, and the Oak Foundation, to advance Indigenous Peoples’ and local communities’ (IPLC) forest tenure rights from 2021 to 2025, recognizing their stewardship role of forests, ecosystem protection, and safeguarding biodiversity. The commitment includes a promise to “promote the effective participation and inclusion of Indigenous Peoples and local communities in decision-making and to include, consult and partner with them in the design and implementation of relevant programmes and finance instruments, recognising the specific interests of women and girls, youth, persons with disabilities, and others often marginalised from decision-making.” A key element for ensuring that IPLC can benefit from such funding is to ensure direct access instead of relying primarily on intermediated financing, as well as to provide safeguards and remedies to allow redress and compensation for grievances.

In addition, more than 30 financial institutions with over US$8.7 trillion assets under management, such as Axa Group and the Sumitomo Mitsui Trust, have pledged to “use best efforts to tackle commodity-driven impacts in their investment and lending portfolios by 2025”, primarily linked to agricultural commodities like beef, soy, palm oil, pulp, and paper. An accompanying finance sector roadmap development effort is supported by Conservation International and Global Canopy, among others, and funded by Norway’s International Climate and Forest Initiative (NICFI).

In Glasgow, the Lowering Emissions by Accelerating Forest Finance (LEAF) Coalition, which was first announced at the April 2021 Leader’s Summit on Climate in Washington, DC, and is supported by NICFI, the United States, and the UK, confirmed that it has reached its target and mobilized more than US$ 1 billion in public-private commitments to support results-based jurisdictional approaches to reducing emissions from deforestation and forest degradation in tropical forests verified against The REDD+ Environmental Excellence Standard (TREES). Private finance support includes big corporate names like Amazon, Walmart, Delta Airlines, BlackRock, Unilever and Nestle, who, according to the COP Presidency write up, are as supporting companies “already committed to deep emissions cuts in their own supply chains, in line with science-based targets.”

Glasgow also prominently featured the Forest, Agriculture and Commodity Trade (FACT) Dialogue, as the culmination of an ongoing year-long process of multi-stakeholder and government-to-government consultations jointly hosted by the UK Presidency and Indonesia and supported by the Tropical Forest Alliance (TFA), which is part of the World Economic Forum. The FACT Dialogue aims to support sustainable trade between commodity-producing and consuming countries to reduce deforestation via a roadmap for action on four key and related areas of work: trade and market development; smallholder support; traceability and transparency; and research, development, and innovation. It has been signed on toso far by 28 countries, including Brazil, the US, and the EU, which collectively represent ¾ of global trade in key commodities such as soy, palm oil, or cocoa. However, as with other similar initiatives, it is not clear what accountability measures, if any, are foreseen to ensure that the voluntary sign on to the principles of the initiative also results also in principled implementation, especially since the roadmap highlights that listed actions “are non-exhaustive, non-binding and do not apply in all circumstances to all countries.” Likewise, it remains to be seen if the corresponding promise of 12 large agricultural corporations—managing over half of global trade in key forest-risk commodities and including Cargill and ADM—to deliver a shared roadmap “for enhanced supply chain action consistent with a 1.5 degree Celsius pathway” and for improving the livelihood of farmers, if created, by COP27 is meaningful or just another “voluntary” and thus often empty promise.

The same concerns apply also to yet another initiative, the Innovative Finance for the Amazon, Cerrado and Chaco (IFACC) initiative launched by The Nature Conservancy, TFA, and UNEP, which act as intermediaries for a promised US$30 billion opportunity to invest in “deforestation-and-conversion-free soy and cattle production in South America”. IFACC announced in Glasgow that it had lined up investments worth US$3 billion, with US$200 million to be disbursed in 2022, and set itself the goal of reaching US$10 billion by 2025. The IFACC Declaration at COP26 was signed by eight financial and agribusiness companies (Green Fund, AGRI3, DuAgro, Grupo Gaia, JGP Asset Management, Syngenta, Sustainable Investment Management, and VERT).

A core feature of these initiatives is that while they attempt to green business practices—with accountability frameworks and transparent follow up often weak and inadequate to ensure that this results in meaningful actions rather than in corporate greenwashing—the focus of the business model itself, namely the continued growth of industrialized commodity production, is never questioned or refuted. The IFACC initiative’s stated purpose is a stark example, as it claims that “With the right approaches, all three biomes can be protected while continuing to grow agricultural production” through “sustainable intensification.”

Looking ahead to 2022 and COP27

The provision of adequate, accessible and human-rights centered climate finance as a matter of justice and equity, and thus with increased transparency and accountability for the pledged and delivered public funding provided by developed countries and the promised financing shifts by the private sector towards climate compatibility, will remain a central push as the international climate process moves into 2022 and toward COP27 on the African continent. Such a focus is even more important in light of the significant shortcomings of the multiple finance decisions and financial sector announcements at and around COP26. How to best bring the fundamental rights and the voices and needs of those people most vulnerable to the climate crisis into some of the processes and dialogues on finance provision formally initiated in Glasgow, such as the determination of the new collective climate finance goal, or the Glasgow Dialogue for discussing potential financing arrangement for loss and damage, remains an ongoing challenge. Similarly, how announced private corporate and financial sector initiatives will work to ensure that they provide benefits and contribute and safeguard the livelihoods, rights (including customary tenure), and traditional knowledge of local communities and Indigenous Peoples instead of further restricting, threatening or endangering them, remains to be clarified. Succeeding in these efforts is indispensable for the credibility of the international climate regime and the promised efforts to shift economic and financial structures and systems, and for the success of accelerating climate actions under the Paris Agreement.