Digging mines, building power plants and providing infrastructure cost billions. Many countries cannot afford the investments; credit agencies and multilateral and private banks are glad to step in. A chapter from the Coal Atlas.

For a foreign contractor, building a coal-fired power station in a developing country entails substantial financial risks – even for prominent firms like Bilfinger, Siemens, Alstom or ThyssenKrupp. Construction is expensive – a big power plant can easily cost over a billion euros – and requires huge investments up front. It can take years for a contractor to get paid. The client, who may be a government-owned or private power generator, may run into financial difficulties. Political crises may halt construction.

To cut the risks for the contractors and their banks, many governments have established export credit insurance. In addition, loans from development banks support the export of mining equipment and power plants. By hedging their risks and availing themselves of lower interest rates, the contractor can offer lower prices. But support for coal projects is a controversial aspect of development cooperation.

On the one hand, new coal-fired power plants are supposed to combat poverty and boost energy supplies in developing countries. On the other, burning fossil fuels alters the climate, pollutes the air and water, and hinders the development of renewable energy. In addition, coal mining is often accompanied by environmental destruction, violations of human rights and exploitative working conditions.

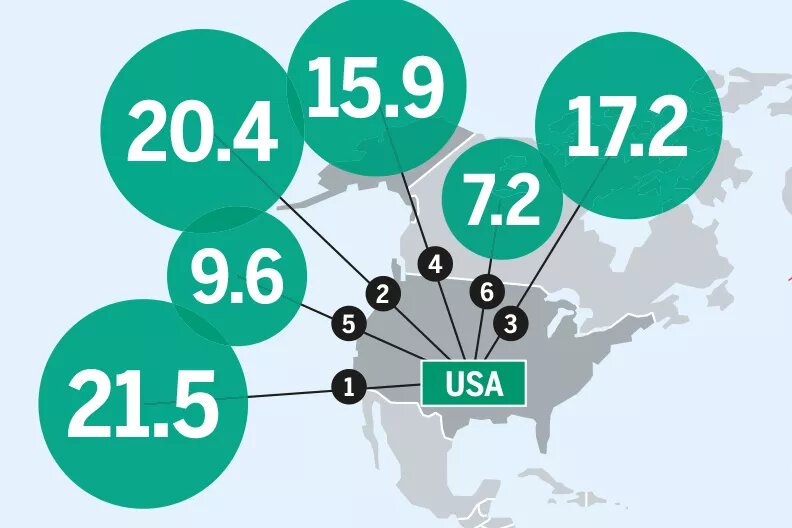

Developed countries support their exports generously. Between 2007 and 2014, more than $73 billion – or over $9 billion a year – in public finance was approved for coal. Nearly half (47 percent) of the total international finance for coal came through export credit agencies in countries that are members of the Organisation for Economic Co-operation and Development (OECD). Japan, an OECD member, led the pack, with $20 billion. China (nearly $15 billion) was followed by two more OECD members, South Korea (over $7 billion) and Germany ($6.8 billion).

The largest recipient countries of coal finance by export credit agencies from 2007 to 2014 are Vietnam (more than $4.5 billion), South Africa (almost $4.5 billion), India (more than $4 billion) and Australia with $4 billion in total. Nearly one-quarter of coal funding from OECD export credit agencies went to High Income Countries. In this period, the total greenhouse gas emissions related to international public finance for coal amounts to almost half a billion tonnes of CO2 per year, or, to put this number in context, the total annual emissions of Italy.

Most of the money goes into building power plants. However, countries such as Russia, Canada and Italy use export credits mainly to finance the digging of new coal mines. Led by the United States and Japan, around $12.9 billion have been used for this purpose from 2007 to 2013. Even though export credits were initially intended to reduce business risks in uncertain markets, they have also recently been used to develop coal mines in politically stable countries such as the United States and Australia.

Multilateral development banks also play an important role alongside the national credit agencies. Between 2007 and 2013 they supported coal projects with subsidies worth $13.5 billion. The biggest donor was the World Bank, at $6.5 billion; the biggest regional donor was the African Development Bank, with $2.8 billion in support. About 90 percent of this money went to build new power plants; the rest went on mining and on modernising older plants.

Faced with persistent criticism, financial support for coal projects has declined sharply since 2010. Since 2013, three development banks – the World Bank, the European Bank for Reconstruction and Development and the European Investment Bank – have decided not to support any more coal projects, or to do so only in exceptional circumstances. Individual governments are also pulling back. Since 2013, the Export-Import Bank of the United States has discontinued support of coal-fired plants – with a few exceptions.

In Europe, France, the Netherlands, the United Kingdom and several Scandinavian countries have also announced they will do the same, though they are still discussing possible exceptions. Germany is struggling to phase out of supporting coal. KfW, a government-owned development bank, has ended its longstanding practice of subsidizing new coal-fired power stations. But its private sector subsidiary, IPEX, will continue to support coal projects if the recipient country has a climate-change policy.

Commercial banks, whose day-to-day operations are beyond government influence, play an even bigger role than the public sources of funding. Between 2005 and 2014, financing for coal projects added up to 500 billion dollars. Together, the 20 leading banks gave 73 percent of the loans.

The member states of the OECD have divergent views on tightening environmental and social standards that they should apply when offering export credits. The biggest issue is the financing of coal projects. The United States and some other countries demand that these types of credits for coal projects be stopped – more transparency is needed in this regard. Export credit agencies seldom make their business information available to the public. Critics demand that in future the agencies should announce promptly whom they are supporting, and in what way.