Energy prices in Europe have soared to new highs since the autumn of 2021, with the Russian invasion of Ukraine amplifying the trend and bringing energy supply to the forefront of conversations regarding the mitigation of impacts of the war on Europe. This study, based on data from Germany and Spain, shows that whilst electricity prices rose, so did the profits of energy companies. Windfall profit taxation can help to soften the blow of high energy prices, but we also need longer term restructuring of the market mechanisms.

The author thanks Mike Parr for his analytical inputs and comments to this analysis.

The consistent increases in fossil gas prices, which predate the invasion but which have been amplified since, are now causing real hardship to many citizens and businesses, with the prospect of more to come. Media reports of fossil fuel companies increasing their profits substantially as a result of these higher prices have become prominent across Europe. In this context, the European Commission confirmed that Member States could indeed consider introducing temporary ‘windfall tax’ measures to reorient some of the financial gains from energy companies to household consumers. Spain had already introduced a windfall tax on energy company profits back in September 2021, while Italy announced one in May 2022. Other countries might follow, with substantial political debate in Germany. Outside of the European Union, we see similar debates, with the UK already implementing a set windfall tax and the USA debating this option, all of which shows the increasing awareness of policy makers on the issue.

What are ‘windfall profits’? And why do they need to be taxed?

The term ‘windfall profits’ refers to exceeding financial gains of companies, made in a short amount of time, due to favourable market factors instead of due to their own investment or hard work, and at the expense of wider society. Such profits, due to their unexpected nature and scale, call for urgent measures such as a ‘windfall tax’ to be adopted as a way to redistribute these gains.

Comparable taxes have been recorded before, including in the years immediately following World War II, when the UK introduced a 100% excess profit tax on companies. Most commonly, however, these taxes have been introduced in the context of previous energy price increases resulting from short-term shocks to global supply chains. Examples include the windfall profit tax on crude oil in countries such as the United States (1980-1988), following the oil crisis of the 1970s, and the windfall profit tax on privatised utilities introduced in the UK in 1997. Windfall taxes have also been previously introduced on profits made in the banking sector, for example in 1982 in the UK, or in 2009 on bonuses from the banking sector in France. The IMF discussed windfall profits as a tool during the financial crisis of 2008–2009. Windfall profit taxes can become necessary when dramatic shifts in financial gains happen over a short period of time. Such taxes are one of the very few short-term measures that help redirect some of the financial flows that occur back towards the wider society. To some extent, windfall taxes can be considered a lighter form of intervention when compared to price capping, as Spain and Portugal are doing – in the case of Spain combining the two tools.

Why have there been windfall profits made in energy between September 2021 and June 2022?

The surge in electricity prices across the EU seen between September 2021 and May 2022 has mostly been caused by two mechanisms: the fluctuations in the gas spot markets, which can be observed below, and the system of marginal pricing, which will be explained below.

The analysis of price data shows that electricity prices followed the spot market prices, whilst gas costs for fossil energy companies only rose slowly, as they are based on forward contracts. Energy companies could therefore sell their electricity for a higher price, whilst their costs only increased at a much slower rate.

Since gas-powered generation of electricity still continues to play a key role in most Member State’s electricity pricing systems, the rise in the cost of gas is pushing up wholesale electricity prices and impacting all forms of production due to the marginal pricing mechanism.

Marginal pricing in electricity markets means the practice of basing electricity wholesale prices on the clearing market, where all electricity generators get the same price as the most expensive form of energy being produced for the grid (in this case, fossil gas–based generation). The classic example would be going to a supermarket and paying for the five items in your basket by taking the most expensive item and multiplying it by five.

The issue of high wholesale prices driven by gas generation has implications for all electricity providers, with windfall profits being recorded by not just fossil fuel companies, but also renewable companies, to a considerable but lesser extent.

The following assessment takes a closer look at the electricity markets from Germany and Spain to identify the emergence of windfall profits and the causal mechanisms. The data analysis is separated into two phases, the months leading up to the Russian invasion of Ukraine, and the months following the outbreak of the war of aggression. This comparative approach helps to identify the common trends and forms the basis for recommending policy solutions, both over time and across the two countries.

Given that gas prices are unlikely to return to previous levels at any point in this decade, it is imperative to understand how the problem can be addressed in the shorter term, as well as in the medium and longer term. Furthermore, as the European Union is accelerating its transition to a net-zero economy and planning to deploy more renewables to remove its dependency on Russian gas, this system is clearly unfit for the present, and also unfit for the future.

Germany

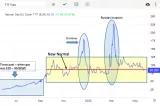

In the case of Germany, a strong correlation between the gas spot price and the electricity price averaged over a week (red line) can be observed during the final months of 2021. This constitutes the foundation of the indicative calculation of windfall profits for electricity producers.

Differences in form can be accounted for by renewables driving electricity prices lower (e.g. week 36 through to week 44). This is explained in further detail in technical Annex I. For Combined Cycle Gas Turbine operators (CCGTs), that forward bought their gas when prices were low, the period from August to December was highly profitable. December was by far the most profitable month, both in terms of profits of €840m and in terms of the selling price per TWh (€163m/TWh). CCGT generation was also profitable in the first five months of 2022, totalling an approximate profit of €1bn for the period from January to mid-May 2022.

February, when there was very high output from onshore wind and good output from offshore, shows a situation where electricity prices can reach single figures, or even go negative. In the case of February 2022, prices reached single figures on several occasions.

Further explanations are available in Annex I.

In conclusion, an increase in longer term buying (when gas was cheap) has meant higher profits because while electricity prices fluctuate, the gas bought forward lags behind the price increase, yielding a massive increase in profits over a short period of time, due to market fluctuations and exposing society and businesses to the shock (meeting the definition of windfall profits).

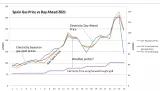

Spain: August to December 2021

In Spain, a similar analysis to the one conducted for Germany shows an even stronger correlation between gas spot prices and day-ahead electricity prices was already occurring in the autumn of 2021, due to less renewables being connected to the system, relative to Germany.

CCGT output for the months August to December varied in the range of 5.5 TWh to 7.7 TWh; however, their profits tripled. In technical Annex II, this can easily be seen by calculating profit on the basis of profit in millions per terawatt hour of generation. Much of the €3,600m profit can thus be seen as windfall profits.

Spain was quick to act; having already introduced a windfall tax in Sept–October 2021, it has now capped electricity prices up until June 2023.

Spain: January to May 2022

The CCGT output cost for the period January to May 2022 varied between €126 and €191/MWh. Profits for the first three months were steady, but then seemed to decline. This may be partly because April had a lower power output compared to the other months. May (the data only covers until 22 May) seems to confirm this trend, and, in any case, gas spot and gas composite prices appear to have finally almost “caught up” with each other.

The windfall profit per Terawatt hour hit a peak in March and then declined. Overall, CCGT output for the first five months of 2022 was lower than the last five months of 2021 in Spain. By contrast, windfall profits were €2bn for 2022, compared to €3bn for 2021. In April 2022, renewables had an impact on pushing prices below €100/MWh more than 10 times (as shown in Annex II).

Germany vs Spain comparison

Events in Germany and Spain from mid-2021 to mid-2022 are very much a “tale of two countries”, with many similarities and some particular differences. Both countries use gas generators to provide electricity, and both countries have significant amounts of renewable generation. Both countries form wholesale electricity prices in broadly similar ways (mostly based on day-ahead prices).

However, the installed base of renewables (only counting wind and solar) in Germany accounts for 53% of the installed base of generation; in contrast, the proportion of the same type of renewables in Spain is 38%. Furthermore, gas generation in Germany runs at a far lower level (rarely more than 15% of overall demand) compared to Spain, where gas often meets 30% of overall demand.

This has led to more intense use of gas in Spain and, in turn, to higher windfall profits for Spanish gas generators (€5.6bn vs €3bn for Germany). Furthermore, renewables in Germany have often driven down wholesale prices, with the period from October to November 2021 being notable for downward price spikes, all caused by large amounts of renewable production.

There have also been windfall profits made by renewable companies as well. However, this has been less of a problem in Spain because the country has used symmetric (two-way) Contracts for Difference (CfDs), unlike Germany, which has used asymmetric (one-way) Contracts for Difference. These contracts mean that the renewable companies in Germany are compensated only when they make less on the electricity markets than assumed in their initial build-out contracts, but if they go above that price, they do not need to return any of the extra profit. In Spain, the two-way contract is more common than in Germany, making this issue a bit less stark in the case of renewable generation. Nuclear plants may also have experienced windfall gains, depending on the contracts under which their power is sold.

What are the solutions to this problem then?

The author of the paper has made a list of some of the solutions, starting with the most urgent ones. Having said that, all of this is rather urgent, because with both climate change and the current geopolitical situation in Europe, moving away from gas power generation is a critical priority. Most importantly, a social justice component to the energy transition has to be guaranteed by ensuring that citizens and businesses are not exposed to unjustifiably higher prices due to market design issues. In the short term, a windfall tax to the end of 2023 is likely to become necessary at the Member State level, alongside possible price caps until the wider market issues are resolved.

Short term:

- A windfall tax on energy producers is required in order to redistribute some of the revenues and reduce hardship among citizens and businesses. Solid monitoring and regulation, as well as good competitiveness on the energy markets, would help ensure that the tax is not passed on to consumers. Some countries (such as Spain and Portugal) have capped prices with the view to ensure this does not happen.

- The windfall tax revenues should be used in conjunction with recycled auctioned revenues from the EU Emissions Trading System to create a package of support for citizens. For example, 10% should come from auctioned revenues at Member State level (the equivalent of the contribution of the CO2 price increase to the higher prices) and the rest from windfall taxes on energy producers.

- The support package for consumers should include both direct payments and measures to improve energy efficiency, which will reduce the impact of high prices in the short and medium terms.

- Support should be in the form of a transfer that does not distort market pricing. For example, a fixed payment to consumers that could be made depending on income.

Medium term:

- Changing the nature of Contracts for Difference, making them two-way rather than one-way, so that they are robust with regard to higher prices. CfDs for renewables are already two-way in some jurisdictions, including Spain and the UK, but this is not the case yet in Germany.

Long term

- Electricity market design should be modified to provide signals for construction and operation of a fully decarbonised system.

- As part of this, wholesale pricing should reflect the cost of renewables.