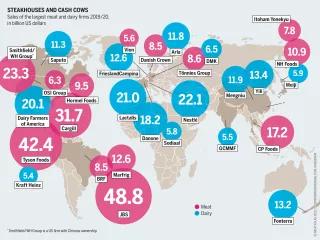

Global meat companies play a major role in determining how meat and feed are produced, transported and traded. Food

is big business: the 100 largest food and beverage firms around the world include 10 main meat producers and processors.

The 10 largest companies in the meat sector have their headquarters in just five countries: Brazil, the USA, China, Japan and the European Union. But they dominate markets around the world and have a presence in all the main meat-producing regions. These firms are responsible for the industrial production and slaughter of massive numbers of animals. The behemoth, Brazil’s JBS, dwarfs all the others. It has more than 400 branches in 15 countries, and slaughters up to 75,000 cattle, 115,000 pigs, 14 million poultry birds and 16,000 lambs every day. Together, that adds up to over 210,000 tonnes of meat a month. Though the second biggest processor, the US giant Tyson Foods slaughters far less, it’s still a staggering number of animals: 22,000 cattle, 70,000 pigs and 7.8 million chickens a day.

JBS, Tyson, Cargill and WH Group have branches throughout Europe. They generate their European profits by selling fresh and frozen meat produced in Europe or imported from countries such as Brazil and Thailand. Brazilian companies BRF and Marfrig distribute directly across Europe or through distribution centres. These meat producing giants use mergers and acquisitions to swallow up small and large firms to consolidate their market power.

Tyson boosted its European presence by buying up BRF’s European operations. JBS acquired a UK-based pigmeat processor to expand its marketshare and is preparing to buy German meat company Tönnies. European firms also have turnovers in the billions. Danish Crown (Denmark), Groupe Bigard (France), Tönnies (Germany), Coren (Spain) and Westfleisch (Germany) are among the biggest producers of beef and pork. Dawn Meats (Ireland) is the European leader in beef and lamb, while LDC (France), Plukon Food Group (Netherlands), Gruppo Veronesi (Italy) and PHW-Gruppe (Germany) are the biggest poultry processors.

Such market power enables these firms to impose low producer prices, and sometimes to force farmers to sell at below their cost of production. That has consequences: farmers have to raise large numbers of animals so they can keep the business of their mighty customers, often relying on public subsidies for support.

In Germany, five companies – Tönnies, Westfleisch, Vion, the Müller Group and Danish Crown – control two-thirds of all processed pork. In the US, meat processing is in the hands of a few corporations. For beef, it is JBS, Tyson, Cargill and Marfrig that together control 85 percent of the market. JBS, Tyson and Hormel account for 66 percent of the pork, while Tyson, JBS, Sanderson Farms and Purdue handle 51 percent of the chicken.

Agri Benchmark, an international non-profit network, reported in 2019 that EU farm subsidies enabled farms to turn an overall profit even though they suffered losses in their cow- and calf-rearing operations. Beef processing firms suffered even greater losses than the farmers who raised the cattle. But they benefited more from the subsidies because many of them are also active as producers of feed grain. In 2016, European pork prices averaged just 1.48 euros per kilogram. European pig raisers – except those in Belgium, Denmark and Spain – lost an average of 7 cents per kilogram of meat they produced.

Apart from the indirect subsidies, the global meat giants also benefit from special government assistance. JBS, for example, received 78 million US dollars in payments from the Trump administration’s farm bailout package during its trade war with China. Incidentally, 20 percent of JBS is owned by the Brazilian Development Bank, which is financed by the country’s tax revenues. In 2017, Brazilian prosecutors imposed one of the highest fines in corporate history for corruption after they discovered that JBS bosses had bribed almost 1,900 officials to advance their business interests.

Some meat giants, such as Cargill, are wholly privately owned. Others are at least partially listed on the stock exchanges. Financial firms are major investors, underwriters and lenders to the sector. Over 2,500 investment banks, private banks and pension funds from around the world invested a total of 478 billion US dollars in meat and dairy companies from 2015–2020, according to Feedback, a non-governmental organization. The biggest investors include Black Rock, Capital Group, Vanguard and the Norwegian government pension fund.